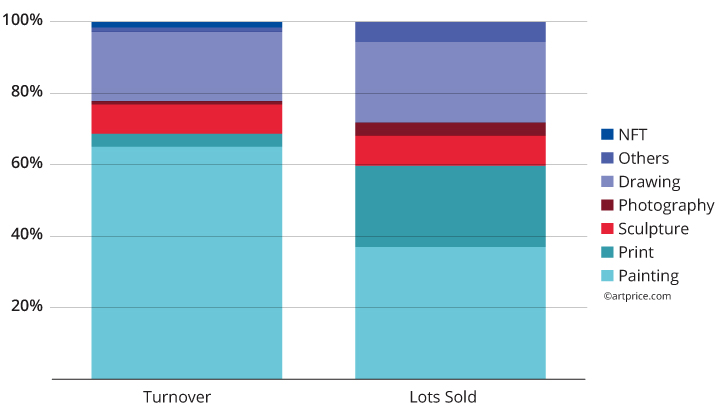

Distribution of works by category (medium)

In 2021, the number of paintings, sculptures, prints, and photographs sold reached a new high. Each of these categories reached a new all-time record in terms of lots auctioned. There was also an increase in demand for less traditional categories, such as tapestry, ceramics, and installations (the volume of which exceeded transactions in the photography medium). So, while the market is becoming denser, it is also constantly diversifying.

The art market’s leading medium, painting, reached a new high in 2021 with $9.5 billion in turnover on a record number of lots sold. The largest segment of the market, paintings, are negotiated in all price ranges, but they account for the vast majority of the very high-end market. Seven of 2021’s top 10 auction results were hammered for paintings (Picasso, Basquiat, Botticelli, Rothko, Van Gogh, Monet and Pollock), fetching prices between $61 million and $103.4 million.

Far behind painting, the drawing medium was in second place accounting for $2.8 billion at the global level. Drawing has more or less regained its pre-pandemic level and represents 19% of the lots sold. The year’s most expensive drawing was by XU Yang, a 17th century Chinese master, that fetched $64.7 million at Poly International in Beijing.

Transactions also picked up well in the sculpture medium with over 53,000 lots sold generating close to $1.2 billion. Badly impacted in 2020 by the pandemic, sculpture has returned to sustained demand. The most expensive sculptures sold were by Alberto Giacometti and Alexander Calder, the only artists to exceed the $15 million threshold in 2021 in the three-dimensional works category.

Global art sales by medium (2021)

→ Painting remains the art market’s principal medium. With $9.5 billion in works sold, it represented 65% of the market’s overall turnover from 35% of its auction transactions. Constantly supplied with new works, particularly in the Contemporary segment, the market absorbed more than 233,500 paintings in 2021, an absolute record. For what may be described as a test year for NFTs, the digital art medium represented a very small niche market (279 lots sold) but one that generated $232 million, i.e. more than the photography market ($142 million from 22,000 lots sold).

The prints medium continued to grow with an exceptional total of $529 million from more than 143,000 lots sold, setting a new record for this more affordable market category which already expanded during the pandemic (against the tide of the contractions in the other creative categories).

The top prices hammered for prints in 2021 illustrate the primacy of Modern and Contemporary works over ‘historical prints’. This trend is all the more marked as BANKSY is ahead of his elders, Warhol, Basquiat, and Matisse, with a new personal record (in the Prints category) set last year at $2.8 million for Girl with Balloon. The price of this print is now higher than Pop Art artist Andy Warhol’s Flowers (1970).

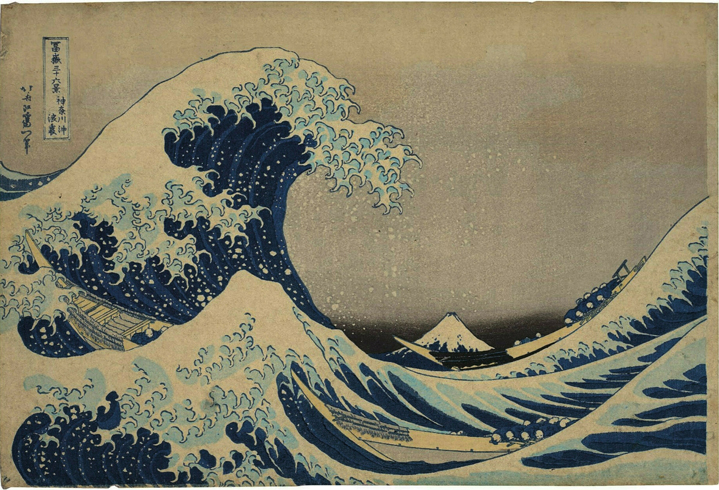

In March 2021, one of the most iconic prints in history, HOKUSAI’s The Great Wave off Kanagawa (Kanagawa oki nami ura (Under the well of the Great Wave off Kanagawa), from 36 views of Mount Fuji) – being a rare print – fetched $1.59 million, ten times its low estimate at Christie’s New York. Demand is particularly strong for any Hokusai print, sales of which have doubled, almost tripled, compared to the level recorded before 2017. In addition, Hokusai’s Great Wave was marketed this year in the form of an NFT with the cachet of the British Museum and the complicity of the French start-up LaCollection.io. The NFT number 1/10 (in the “super rare” category) reached the price of $45,000 (10.6 Eth).

26 x 38.4cm

39.7

39.7