Geographical breakdown of the Art Market

After a period of lethargy that gave way to a sharp contraction, the art market has experienced a rebound led by auction houses that managed to pursue their activities throughout the worst of the health crisis. In reality, the results for the year 2020 are extremely encouraging given the unprecedented context.

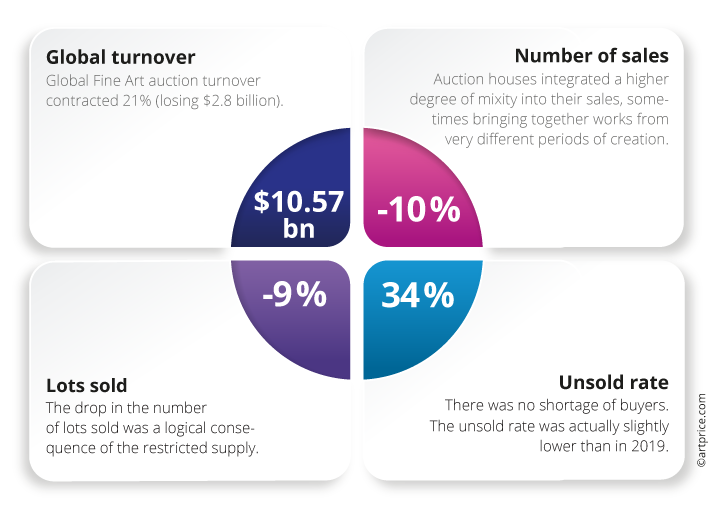

Key figures

The secondary art market is currently proving to be much more resilient than in previous crises, notably that of 2009 when global Fine Art auction turnover dropped 36%. In 2020, it fell just 21% (down to $10.57 billion), a surprisingly small contraction given the impact of the Covid-19 crisis on the Art Market as a whole (galleries, museums, fairs, etc.).

The 2020 contraction was mainly linked to an understandable loss of momentum at the high-end of the art market. From the first lockdown, lots of major collectors decided to postpone their sales until better times.

The result is that more than 500 results above the million-dollar line were absent in 2020 and the number of lots in this category fell by a third compared with 2019. In the West, the results have been greatly affected by a short supply of masterpieces, with a 30% contraction in annual turnover, despite a stable number of transactions. In contrast, China’s turnover rose slightly (+2%) despite a sharp drop in the number of transactions (-40%), thanks to a number of high-level sales during the second half of the year.

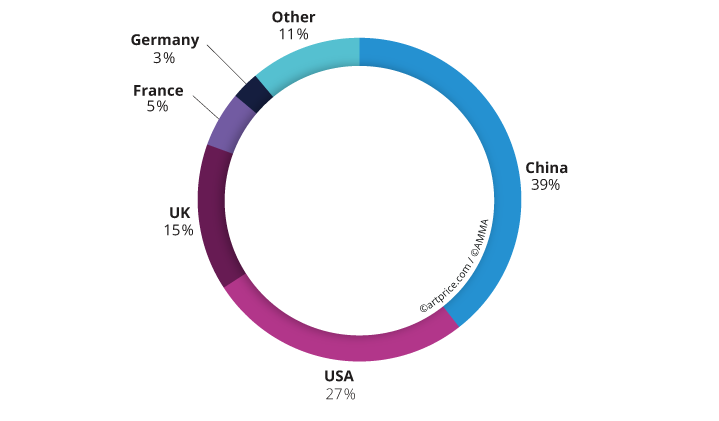

Turnover by country (top 5)

→ Reactions differed from one country to another in this first year of the health crisis. In France, the UK and the United States, turnover dropped between -30% and -39%; but in China (+2%) and Germany (+11%) the figures actually improved, despite a more limited supply. China regained its leading position in the world on the back of some major sales of Old and Modern works in the second half of the year.

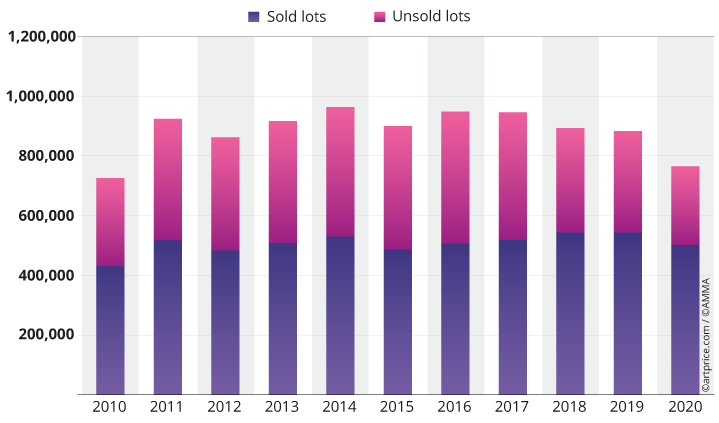

Evolution of sold and unsold lots

→ In total, 2020 lost 130,000 works from the art supply chain (down 14%) compared with 2019. However, thanks to attractive estimates and strong demand throughout the year, the unsold rate fell to 34% versus 38% in 2019.

Asia and the West

The performance of China’s art market is remarkable: despite a 40% drop in the number of lots sold, its turnover grew 2% to reach $4.16 billion. China therefore accounted for 39% of the global art market in 2020, almost as much as the United States (27%) and the UK (15%) together.

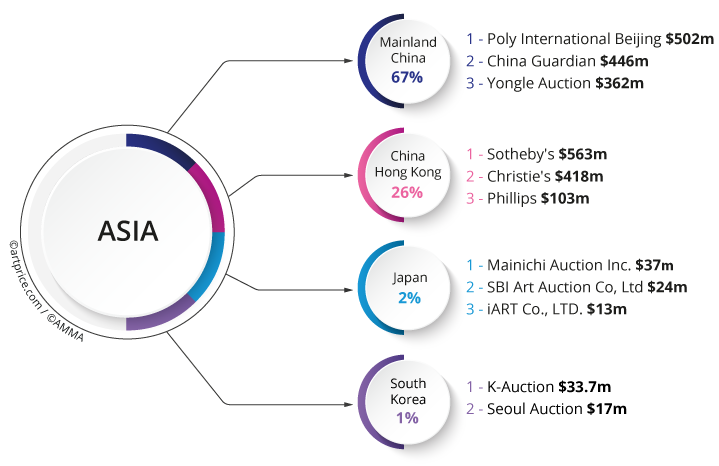

Breakdown of turnover and leading auction houses in Asia (2020)

Asia: Number 1

The first continent affected by the coronavirus, Asia enjoyed a strong resumption of auction activity during the second half of 2020.

With a cumulative total of nearly $1 billion, Poly International and China Guardian accounted for a third of the market in mainland China. We also note a spectacular breakthrough by Yongle Auction in Beijing, with more than $360 million in revenue.

Sotheby’s was nevertheless the continent’s leading vendor from its salesroom in China Hong Kong, taking more than $563 million in 2020, the best Fine Art turnover total in all of Asia. China Hong Kong now represents a vital part – almost a quarter – of Sotheby’s global Fine Art turnover.

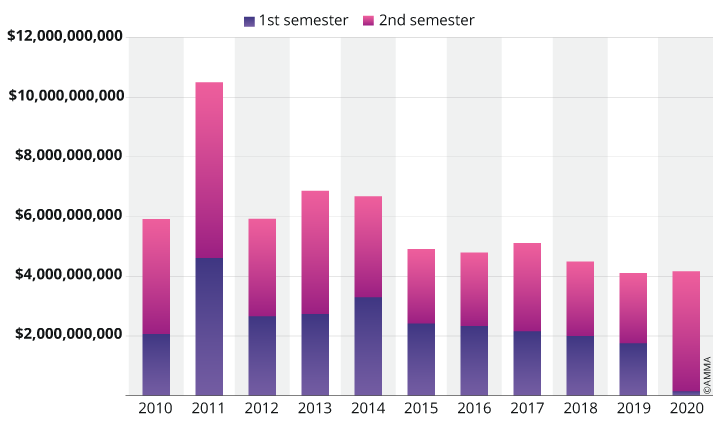

China’s Fine Art turnover in the past decade

→ After a catastrophic first half in China, sales of artworks accelerated considerably in the second semester, ending with a slight increase for the year as a whole versus 2019 (+2%).

The West’s leading auction houses: Sotheby’s at the top…

After several weeks of uncertainty and adjustment, the majors Sotheby’s, Christie’s and Phillips returned to proposing prestigious artworks at the beginning of the summer of 2020. On 29 June, Sotheby’s sale of a Francis Bacon triptych for $84.5 million substantially restored market confidence.At the end of the year, Sotheby’s still retained a significant lead on the American market and was the leading auctioneer in both the UK and Italy. Number 1 in France, Christie’s, together with Sotheby’s and Artcurial, are the only auction houses in France generating an annual turnover above $5 million. Together, the three houses account for almost two-thirds of the country’s Fine Art auction turnover (61%).In terms of the Western secondary art market as a whole, Sotheby’s and Christie’s account for approximately 60% of the proceeds from sales of artworks (with a combined annual total of $3.7 billion).

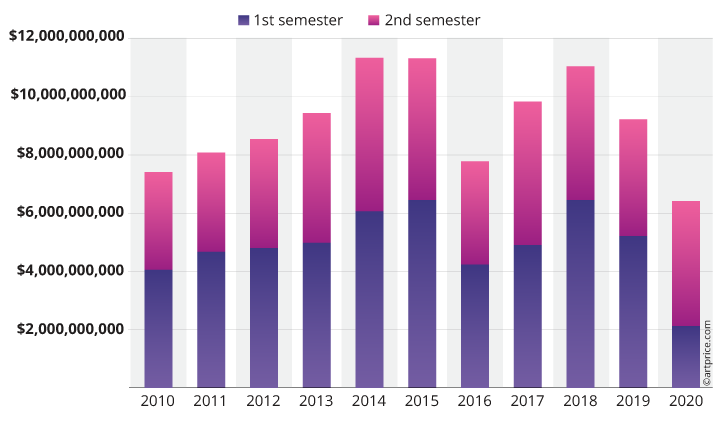

Annual auction turnover totals in the West

→ The pandemic had a strong impact on the West’s secondary art market (-30%) despite a stable number of lots sold (468,000) compared with 2019. The American market posted the heaviest losses. Its annual result was down $1.8 billion versus the previous year with the number of works fetching over $10 million almost halved in New York (30 vs. 58 in 2019). Following the contraction of its high-end market, the United Kingdom also posted a substantial turnover shortfall (down $653 million).

Two contrasting semesters…

The first lockdown upset the ecosystem of an Art Market dependent on the circulation of visitors, artworks and collectors. The sudden interruption created a substantial economic imbalance between the two halves of the year.

During the first semester, the paralysis (postponements and cancellations) of auctions generated very substantial turnover shortfalls (vs. the year earlier period) of approximately 60% in the West and 91% in China; but a surge in demand was quickly felt. Already at the end of June, Sotheby’s managed to generate $231 million during its Contemporary Art sale, and then $194 million from its De Rembrandt à Richter sale at the end of July. On 7 July Christie’s bounced back with ONE: A Global Sale of the 20th Century that generated close to $300 million. In China Hong Kong, the month of July was the most dynamic of the year. During these highlights of the year Sotheby’s sold Francis BACON ’s Inspired by the Oresteia of Aeschylus for $84.5 million; Christie’s sold Roy LICHTENSTEIN’s Nude with Joyous Painting for $46.2 million and Sotheby’s China Hong Kong hammered SAN Yu’s Quatre Nus at $33.3 million. Each of these results represented the artists’ third best-ever sales result.

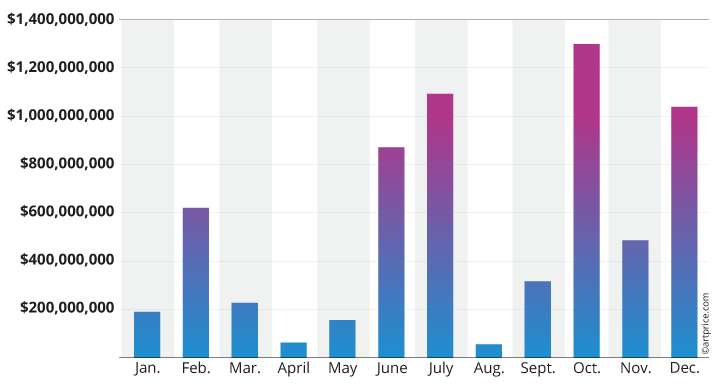

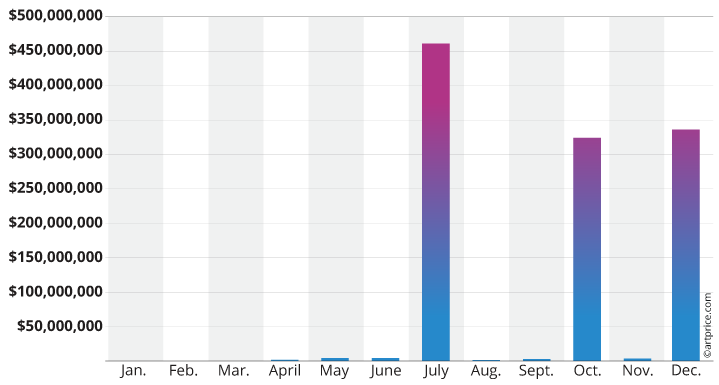

Monthly turnover in the West (2020)

→ After the initial shock of the pandemic, the autumn and winter sessions became decisive. Fortunately, by then, auctioneers had enough time to react and buyers were once again disposed to submitting generous bids. For example, on 6 October in New York, Christie’s hosted the most profitable sale of the year (20th Century) generating $309 million. In December, the success of its China Hong Kong sales of Modern & Contemporary Art produced a new record for “Christie’s Asia” (at $224.7 million). The market’s dynamism was evident until the last days of the year and the momentum propelled the H2 totals beyond those obtained in H2 2019, with a 7% increase in the West and, above all, a 71% increase in China.

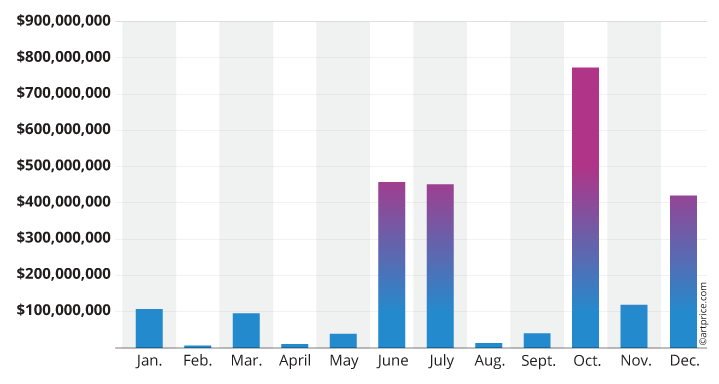

Monthly art auction turnover in China Hong Kong (2020)

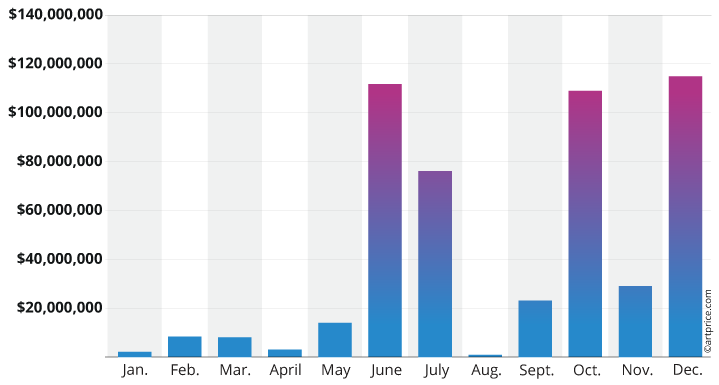

Monthly art auction turnover in New York (2020)

Monthly art auction turnover in Paris (2020)

30.6

30.6