The year in review

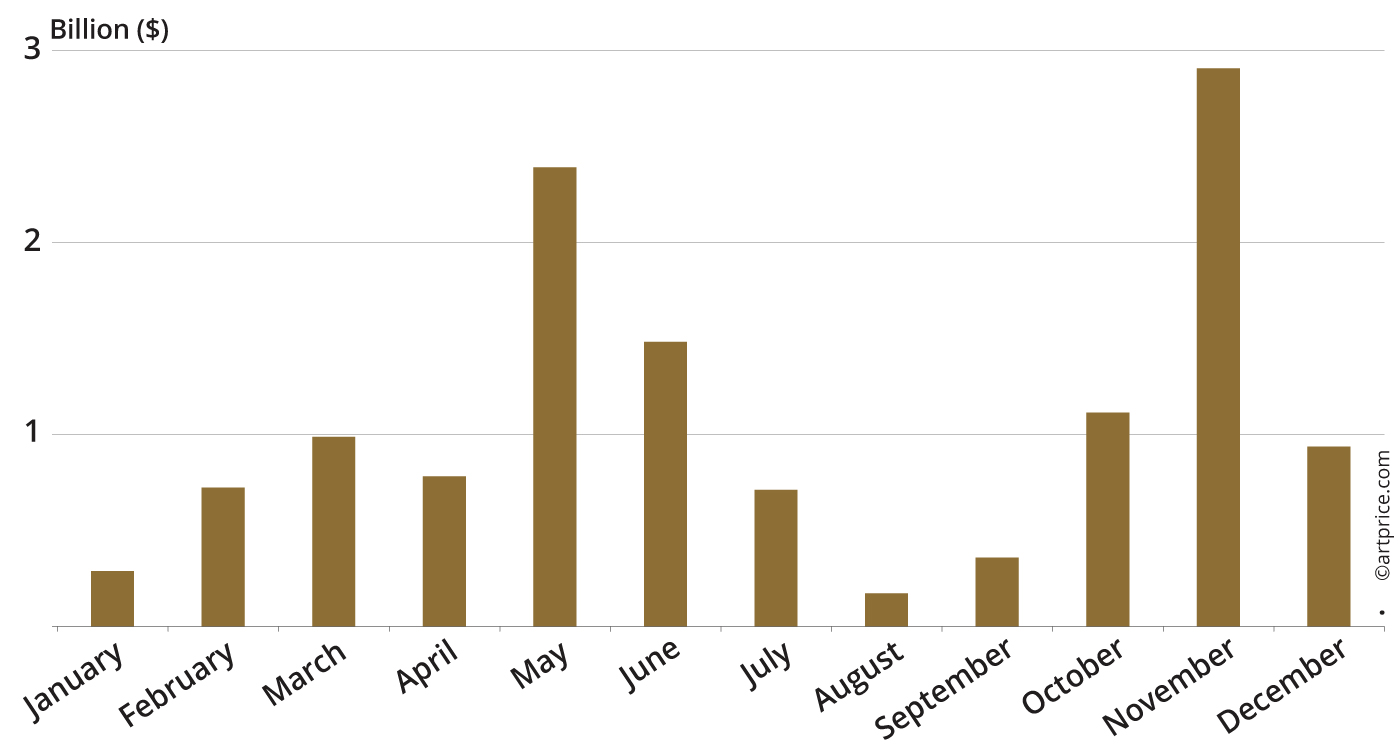

In addition to the highlights of the traditional prestigious New York sales in May and November, a month-by-month breakdown of the year reveals the highs and lows and the strategies and expectations of the global art market.

H1 2023

The art market procrastinated throughout the first half of 2023, ending the period with a 20% slowdown in global turnover (vs. H1 2022). This strong decline was due to the consignment of fewer high-end and exceptional quality artworks than a year earlier. The absence of works valued at over $10 million was responsible for 87% of the contraction in the first half of the year (or -$1.4 billion). In 2023 only 0.02% of transactions were hammered in this price bracket (>$10 million) compared with 0.03% in H1 2022, and that difference was enough to reduce the half-year result by almost $1.5 billion.

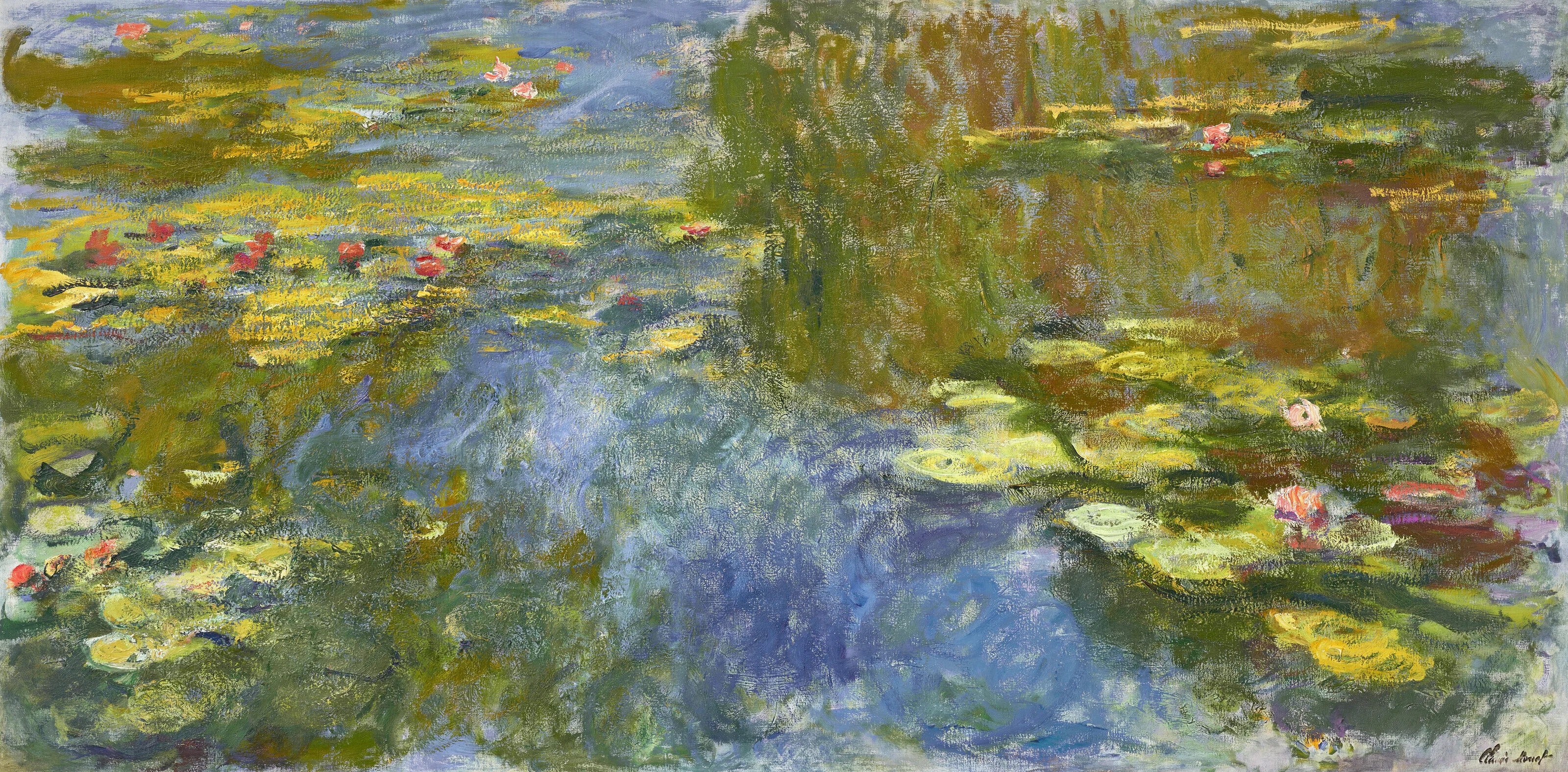

Certain major artists posted drastic reduction in their auction turnovers: in H1 2023 Andy Warhol was down 89%, Mark Rothko shrank 95% and Francis Bacon’s turnover fell 73%. These contractions clearly impacted the overall H1 2023 turnover total, as did the absence of major 19th century masterpieces, notably, by Claude Monet, whose auction turnover fell 94%. However, although the best works by these major artists were absent from the prestige sales, their prices have not shown any sign of contraction.

Despite the drop in global auction turnover, the overall results remained positive in a number of respects: the volume of transactions remained at an unprecedented level; the unsold rate improved slightly (from 34% in H1 2022 to 31% in H1 2023), and China’s art market considerably stabilized.

The results of the American market in H1 2023 perfectly illustrated the contrast between the strength of general demand and the weakening of the high-end segment: while sales turnover declined by a quarter in H1 2023 due to the absence of exceptional collections coming onto the market (as in 2022), the overall volume of transactions increased by 3%.

January

The year 2023 opened with one of the most important collections of Baroque art ever to appear on the market: the 10 masterpieces from the Fisch Davidson Collection sold on January 26 by Sotheby’s generated $50 million, of which, over half was hammered for a painting by Peter Paul Rubens titled Salome presented with the Head of Saint John the Baptist (1609). The painting changed hands for $26.9 million after just two minutes of bidding, although the work was expected to fetch up to $35 million. However this timid result for a very powerful canvas was followed by a superb result for a portrait of a young man by Bronzino (stolen during WWII) that fetched double its high estimate, setting a new record for the artist at $10.6 million.

March

On 1 March at Sotheby’s, a monumental work by Edvard MUNCH joined his top-ten secondary market results, while Wassily KANDINSKY reached a new auction record at nearly $44.7 million with a superb canvas from 1910, produced at a pivotal moment for the Russian painter. These two works by Munch and Kandinsky were both looted during the Second World War and recently returned to their heirs.

In March, art market professionals became concerned about the risk of an increase in the import tax on works of art (20% compared to 5.5%), which would have severely undermined the competitiveness of European countries had the measure been adopted. Meanwhile, Asia Week was in full swing in New York, where Christie’s achieved an all-time record of $2.76 million for one of the best known prints of HOKUSAI’s Great Wave off Kanagawa. The existing auction record for this iconic image by the illustrious Japanese artist climbed by more than a million dollars, Christie’s having sold another print for $1.59 million in 2021.

April

Sotheby’s celebrated its 50th anniversary of activity in Asia with a commemorative sale of works by Eastern and Western masters during which it fetched the highest auction price for a sculpture by Japanese artist Yayoi Kusama: $7.9 million for Pumpkin (L), a bronze work measuring almost two and a half meters high.

May

The American Central Bank raised its Fed Funds rate to the highest level since 2006 (source FOMC), which was not conducive to excellent sales in May. In New York, where Christie’s sales totaled $1.4 billion in May 2022 (notably thanks to the Anne Bass and Doris Amman Collections), they peaked at $930 million for the two collections offered: the first, Modern and Contemporary, collected by the media mogul S.I. Newhouse, who died in 2017, did reasonably well, taking $177.8 million on 11 May. But, a few days later, the Contemporary collection put together by Gerald Fineberg, a major real estate investor who died in 2022, reached only $197 million versus Christie’s low estimate of $235 million. The collector’s heirs apparently decided to forego the minimum price guarantees offered by the auction house and third parties, which would certainly have allowed the works of Lucio Fontana, Willem de Kooning, Roy Lichtenstein, Gerhard Richter and Christopher Wool to reach at least the low estimates. Meanwhile Sotheby’s and Phillips also experienced turnover contractions with the latter dropping from $255.9 million to $108 million in May 2023 vs. May 2022. But the news was not all bad: Sotheby’s, for example, hammered the second best-ever result for René MAGRITTE when his The Empire of Lights (1951) from the Mo Ostin Collection sold for $42.3 million.

June

On 15 June, Sotheby’s hosted a sale dedicated to the pioneers of Generative Art with works in the form of NFTs by Tyler Hobbs, Jeff Davis, Casey Reas, Hideki Tsukamoto and Dmitri Cherniak. The latter obtained a new record at $6.2 million for his NFT Ringers #879 (The Goose) (2021). At the end of the month, Sotheby’s returned to the classics and set a new record for Gustav KLIMT at $108.39 million, well beyond the $82 million initially expected. In a context of market slowdown, a sale above the $100 million threshold is a reassuring sign that major collectors still have an appetite for important works.

Monthly evolution of global Fine Art and NFT auctions (2023) (AT)

H2 2023

In the second half of 2023, global art auction turnover rose to $7.79 billion (+9.4% vs. H1 2023) thanks to renewed energy in the ultra high-end market. The presence of remarkable works, particularly in the New York and Hong Kong sales, raised the number of results above $10 million to 67, after the sharp decline during the first half of the year to 57.

July

London’s Old Masters sales generated a couple of surprises: on 5 July, Sotheby’s offered a painting depicting the Pentecost (circa 1490), the largest and most important work among those recognized as being by the THE MASTER OF THE BARONCELLI PORTRAITS. The work fetched a new record at $10 million for this little-known artist who was the presumed student of Hans Memling and whose works can be found at the Louvre and at the Courtauld Institute. The following day, Christie’s sold The artist’s workshop with a seamstress, a work by a long-forgotten Flemish artist, Michiel SWEERTS, for a record price of $16 million against a high estimate of $3.8 million. The result put The artist’s workshop with a seamstress among the year’s top results in the Old Masters category after a drawing by Wang Meng, two works by Rubens, an exceptional calligraphy by Zhao Mengfu and a set of two portraits by Francisco José de Goya y Lucientes.

October

On 5 October Sotheby’s suffered a number of disappointing results. In Hong Kong, Liu Yiqian and Wang Wei’s superb collection seemed to loose its nerve after the flagship lot, Portrait of Paulette Jourdain by MODIGLIANI reached just $34.8 million, which was $8 million less than in 2015. Then Léonard Tsuguharu FOUJITA’s superb Nu au chat (1930) remained unsold despite a low estimate of $5 million, the price paid for the work in 2016. On the other hand, a monumental work by Julie Mehretu set a new record for the artist at $9.3 million on the same day.

The following week in London, Sotheby’s was forced to buy in its star lot, a powerful abstraction by Gerhard Richter estimated $19 – 29 million (two other Richter works both exceeded $30 million in November). However, in the same week Christie’s London hosted totally reassuring sales that generated a higher turnover total than the same sales a year earlier: Its 20th/21st Century Art sale took $54.5 million with a sales ratio at 89% in value. The second part of the sale reserved for the Samuel Josefowitz Collection generated $63.2 million, with 90% of the lots sold in value. Offering rare works by the Nabis, the Pont-Aven school and the largest private corpus of Rembrandt engravings, the sale posted remarkable results, particularly for Kees VAN DONGEN’s superb painting, Tranquility, which fetched $13 million (double its high estimate), and for Félix VALLOTTON’s Five hours (1898), which set a new auction record for the artist at $4.4 million.

After the sale of Modigliani’s Portrait of Paulette Jourdain in Hong Kong, the month’s second best result was hammered in Paris for one of the most significant paintings by Joan MIRO offered on the market – Peinture (femmes, lune, étoiles) (1949) – which reached $21.9 million on 20 October at Christie’s.

Among nearly 50,000 artworks sold in October around the world, the 10 best results totaled $154 million, only 10 million less than in October 2022, and this recovery was the prelude to further good results in November.

Top 10 Fine Art and NFT auction sessions in 2023

| Auction house | Title | Date | Sales proceeds | Lots sold | Unsold lots | Maximum price | |

|---|---|---|---|---|---|---|---|

| 1 | Christie’s New York | 20th Century Evening Sale | 9. Nov. 2023 | $640,846,000 | 61 | 2 | $74,010,000 |

| 2 | Sotheby’s New York | The Emily Fisher Landau Collection: An Era Defined | 8. Nov. 2023 | $406,422,100 | 31 | 0 | $139,363,500 |

| 3 | Christie’s New York | 20th Century Evening Sale | 11. May 2023 | $328,779,600 | 44 | 12 | $43,535,000 |

| 4 | Sotheby’s New York | Modern Evening Auction | 16. May 2023 | $303,104,250 | 40 | 8 | $53,188,500 |

| 5 | Sotheby’s New York | Contemporary Evening Auction | 15. Nov. 2023 | $250,514,100 | 43 | 3 | $42,000,000 |

| 6 | Sotheby’s London | Modern and Contemporary Evening Auction | 27. Jun. 2023 | $242,610,830 | 50 | 9 | $108,743,230 |

| 7 | Sotheby’s New York | Modern Evening Auction | 13. Nov. 2023 | $223,335,300 | 31 | 3 | $30,783,000 |

| 8 | Sotheby’s London | Modern & Contemporary Evening | 1. Mar. 2023 | $191,386,640 | 29 | 7 | $44,721,120 |

| 9 | Christie’s New York | Masterpieces from the S.I. Newhouse Collection | 11. May 2023 | $177,792,000 | 16 | 0 | $34,622,500 |

| 10 | Sotheby’s New York | Contemporary Evening Auction | 18. May 2023 | $167,453,500 | 27 | 0 | $32,804,500 |

| © Artprice | |||||||

November

In November, Christie’s and Sotheby’s together hammered $1.2 billion at their New York sales of Modern and Contemporary Art. Christie’s 20th Century Art sale on 9 November generated a total of $640.8 million and its highest result was $74 million for Claude MONET’s Bassin aux nymphéas (1917-1919), a vast canvas measuring 1 x 2 meters kept in the same family collection for 50 years. It fetched the year’s third best auction result. At Sotheby’s, the most coveted private collection of 2023, that of the late Whitney Museum patron Emily Fisher Landau, generated $424.55 million. All of the works found buyers, including nine at over $10 million and one – Pablo PICASSO’s 1932 portrait of Marie-Thérèse Walter, Femme à la montre – at $139.4 million, the world’s highest art auction result in 2023. The Chara Schreyer Collection, also sold by Sotheby’s, achieved good results as well, notably $18.7 million for a key work by Frank STELLA.

The two auction houses subsequently hosted prestige sessions in Hong Kong with Christie’s 20th/21st Century Art Evening Sale taking $88.9 million from fifty lots, which was two million more than at the same session in November 2022. The jewel of this sale, San Yu’s Femme nue sur un tapis, fetched $24 million, $5 million above its high estimate. Lastly, we note that while the best works by Yayoi Kusuma, Yoshimoto Nara and Zao Wou-Ki appear to have motivated bidders, works by George Condo, Richard Prince, Rudolf Stingel, Genieve Figgis and Zhang Xiaogang received a less enthusiastic reception, sometimes leading to failed sales.

December

On 7 December, the dispersal of REMBRANDT engravings collected by collector Sam Josefowitz resulted in three new 7-digit results at Christie’s (Saint Jerome reading in an Italian landscape, The Three Crosses, and The Three Trees). Rembrandt was also in the spotlight at Sotheby’s where his Adoration of the Magi returned to the market after being reattributed to the artist. Previously considered from the “Rembrandt Circle”, in 2021 it nevertheless soared to $992,700 versus an estimate of $11,000 at Christie’s Amsterdam. But in 2023, after its reattribution, this painting – measuring just 20 cm – sold for $13.79 million. Re-attributions of this type – involving intuition, conviction and a great deal of research – are always one of the most exciting phenomena on the art market.

48.7

48.7