The top 10 drawings at auction in Q1: China leads

[14/04/2023]In view of Chinese auction results hammered during the first quarter of this year, the Chinese art market is recovering from its covid-related trough. And if we look specifically at global auction results for artworks that are classified as drawings, the top 10 results in Q1 reward nine Chinese artists and only one Western artist, René Magritte.

Chinese drawings still fetching the best results

The latest Annual Report on the 2022 global art auction market published by Artmarket by Artprice and Artron clearly shows a significant contraction of the results hammered for drawings. In China, this contraction began well before the Covid pandemic (lien : consulter notre rapport). The report states that “the number of results for drawings above the million-dollar threshold has been shrinking since 2015. The figure for 2022 was 249, roughly half the average number hammered between 2010 and 2017.” The scarcity of works by important Old Master and Modern Chinese masters is the primary cause of the contraction. But, although the pace of transactions is slower than ten years ago, Chinese collectors are no less mobilized and competitive when it comes to acquiring the key signatures of their history, and hence the prices of works by Chinese masters are still very high. And since drawing in China is as important as painting in the West, the prices of works by these Chinese masters clearly dominate those hammered for drawings by Western artists. It is therefore no surprise to see that nine works by Chinese artists dominate our top 10 ranking of global auction results for drawings in Q1 2023. Artprice takes a rapid look at the Chinese artists who dominate the global drawing market.

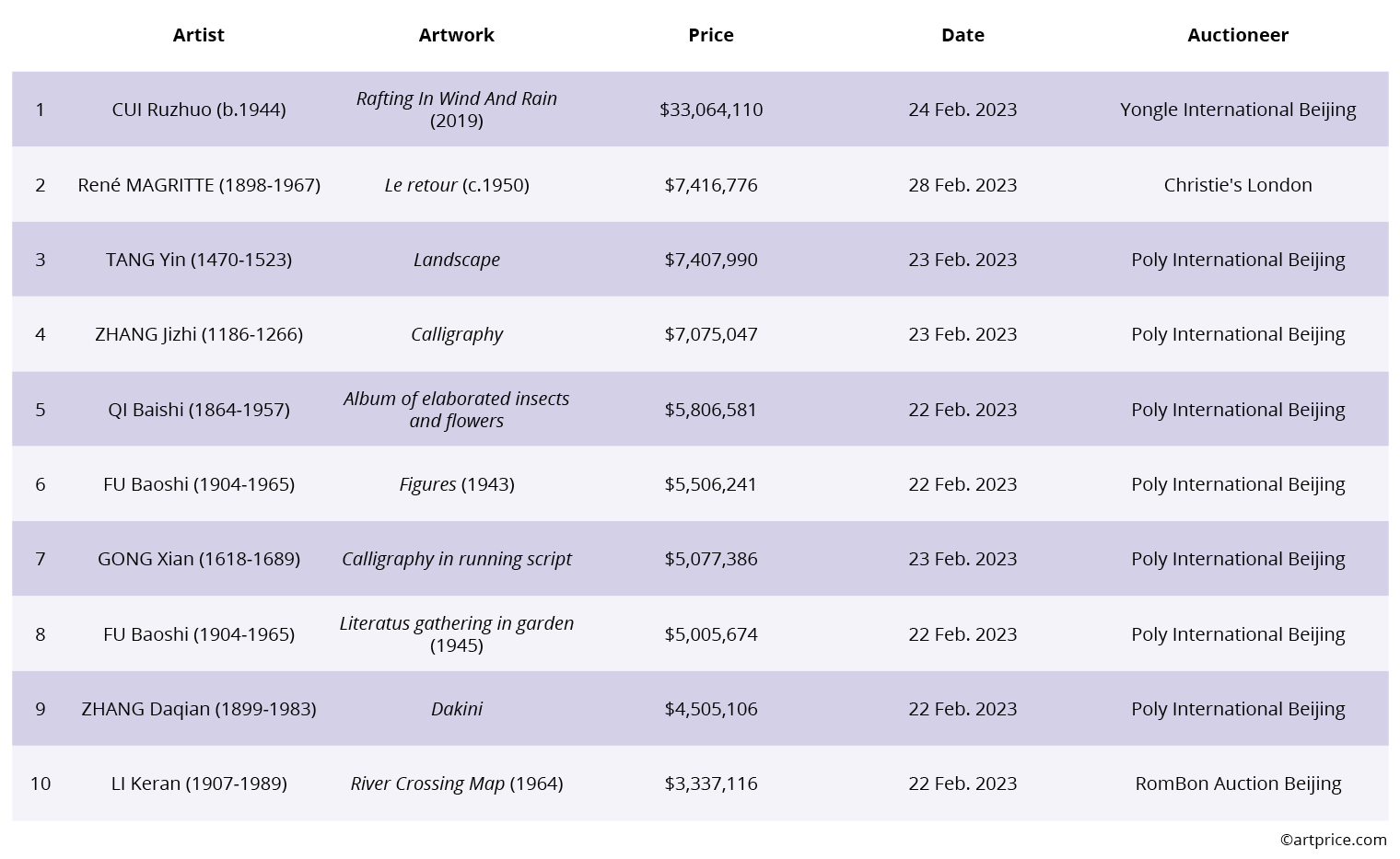

Table: Top 10 auction results for drawings in Q1 2023

Historical artists

Our ranking of the world’s top 10 auction results for drawings in Q1 has three Old Masters: TANG Yin, ZHANG Jizhi and GONG Xian. Their works, all created before the 17th century, are so rare that competition between collectors is extremely intense.

ZHANG Jizhi (1186-1266)

Auction record: in 2016 one of his precious calligraphic drawings reached $9 million in Beijing (Calligraphy (楷书“华严经”残卷)). The result hammered last February (for $7 million) for another of his calligraphic works was not that far behind.

Number of lots sold per year: Several years can go by without a single work by Zhang Jizhi coming to auction. He is one of the rarest signatures on the art market.

Annual auction turnover: Zhang Jizhi could reach a historic annual total if another of his drawings is presented at auction this year. 2016 was his best year to date with a total of $8 million from three transactions.

Auction record: $26.6 million hammered during the strong peak of the Chinese art market in 2011 (Landscape).

Number of lots sold per year: his market is running dry and only two works were sold last year. His major works have become much rarer.

Annual auction turnover: nowadays, it rarely exceeds $10 million, whereas in 2011 it exceeded $35 million from no less than around fifty lots sold.

Auction record: $6 million hammered in 2013 for a mountainous landscape measuring over two meters high.

Number of lots sold per year: rarely more than 10, and the number of transactions has been falling for ten years.

Annual auction turnover: Gong Xian’s total for the first three months of this year (more than $4.4 million) is already four times higher than that recorded for the whole of 2022.

20th century and Contemporary Chinese drawings

Western collectors are not very familiar with the names of CUI Ruzhuo, ZHANG Daqian, FU Baoshi, QI Baishi and LI Keran, nor with their creations. These artists are nevertheless key figures in Chinese art. A work by Qi Baishi generated the world’s highest auction bid ever submitted for a drawing ($140.9 million) ahead of results hammered for paper versions of The Scream by the Norwegian artist Edvard Munch (The scream (呐喊)).

Auction record: $140.9 million in 2017 (ID 14831322). Qi is the first Chinese artist to have crossed the $100 million threshold. He is one of the most expensive artists in the world, on the same level as Picasso, Modigliani and Giacometti.

Number of lots sold per year: more than 300, with a solid ‘sold through’ rate that sometimes exceeds 80%.

Annual auction turnover: more than $88 million last year, which placed him ahead of Joan Miro in our 2022 ranking by annual auction turnover.

Auction record: $47.2 million last year at Sotheby’s Hong Kong, the best result ever hammered by Sotheby’s for a Chinese artwork (Landscape after Wang Ximeng (仿王希孟〈千里江山圖〉)).

Number of lots sold per year : between 350 and 450 on average. The supply is however half what it was during the peak of the Chinese market in 2011.

Annual auction turnover: with nearly $183 million last year, his annual auction performance was just behind that of Vincent Van Gogh.

Auction record: $36.2 million hammered in 2011 for an exceptional set of landscapes (Landscapes).

Number of lots sold per year: between 60 and 100, compared to double that range ten years ago.

Annual auction turnover: as supply has been thinner for several years, his annual auction total is tending to shrink. The last peak dates back to 2017.

Auction record: one of his most beautiful landscapes, Red over the Mountains as if the Forests are Dyed, reached $46.4 million in 2012 (Mountains in red).

Number of lots sold per year: roughly one hundred per year, compared with roughly two to three times more a decade ago.

Annual auction turnover: considerably reduced over the last decade as a result of the scarcity of his works, particularly his most beautiful drawings.

CUI Ruzhuo (1944)

Auction record: $39.5 million in 2016 (The Grand Snowing Mountains (飛雪伴春))

Number of lots sold per year: about ten only. The works are rare and highly sought-after. None remained unsold last year, nor during the first quarter of 2023.

Annual auction turnover: declining for several years, due to the scarcity of works at auction.

.

The second largest segment of the global art auction market after paintings, drawings accounted for 14% of global art auction turnover from 21% of global art auction transactions. The slowing market for major Chinese artists is being offset by an expansion of the supply of drawings at the global level that pushed the global drawing market to an all-time high transaction volume in 2022, with a record of 150,000 drawings sold.

30.6

30.6