Guide to art auctions for under $10,000

[11/12/2024]

Episode 3: Five keys to investing in art

Auction acquisitions for under $10,000 can turn out to be real gems. Between little-known masterpieces and essential artists, immerse yourself in a market that is as accessible as it is promising, where good flair can pay big dividends.

For less than $10,000, a discerning art enthusiast can find works at auction by the likes of Andy Warhol, Le Corbusier, Marlene Dumas and Takashi Murakami in a wide range of mediums including multiple-edited works like prints or sculptures, but also unique works like original drawings and paintings. In fact this price range is where works by icons of the past rub shoulders with works by emerging Contemporary stars, and it is the perfect place to find treasures with a limited budget.

Indeed, artworks acquired for less than $10,000 often generate significant capital gains.

In our two previous articles about the under $10K art market, we focused on where to buy works at auction, and what strategies to adopt to build a collection. In today’s article, Artprice takes a closer look at the notion of investing in art.

Of course, navigating between making an impulsive acquisition and making a wise financial investment is not an easy task. But that is precisely where Artprice comes in handy: by analysing and understanding the intricacies of the market (via Artprice’s artists statistics for example), you will see that seemingly similar works by Jeff Koons or by Andy Warhol can have very significant price differences.

Content

Extraordinary capital gains

Balloon Dogs: soaring prices and collection secrets

Why do the prices of Warhol’s Marilyns vary so much?

Bonus: complex ‘seller fees’ elucidated

Extraordinary capital gains

In the upper echelons of the art market, returns on investment can reach dizzying heights, sometimes amounting to millions of dollars. This fact is regularly illustrated by resales of well-purchased key works by the likes of Pablo Picasso and Jean-Michel Basquiat.

But it’s not just the best works by big-name artists that generate lucrative gains. Lesser-known artists and affordable works by star artists can also generate spectacular gains. Take this striking example: a drawing by Eugène Boudin, acquired for less than $6,000 in 2017, was resold for $259,000 this year, generating an impressive profit of $253,000 in just seven years.

Artprice has compiled a panorama of the best capital gains made since 2023, on works previously acquired for less than $10,000 in auction rooms.

Pastel/blue paper, 15 x 23 cm

Sold for $259,000 at Christie’s London in March 2024

Between 2017 and 2024, this drawing gained $253,000 in value!

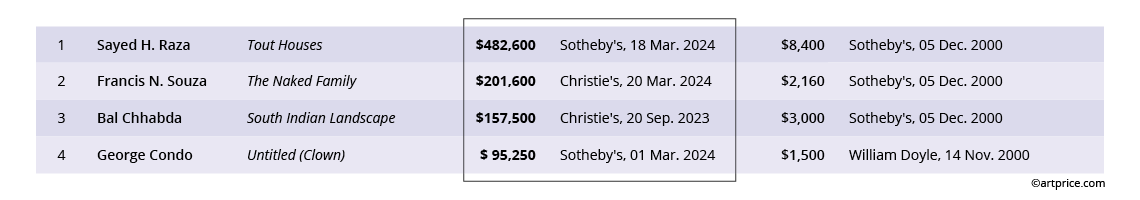

The rise of Indian masters in New York

In New York, the strongest price increases have been hammered for works by India’s Modern masters. Sotheby’s was a pioneer in introducing these artists to American collectors in the early 2000s, and their works were purchased at relatively low prices. Since then, the Indian art scene has established itself as one of the most dynamic, with prices multiplying by 50, 60, or even more times.

Among the most notable examples: Urban view by Sayed Haider Raza and a landscape by Bal Chhabda saw their values explode. But it is Francis Newton SOUZA who takes first prize. His drawing, The Naked Family, purchased for around $2,000 in the early 2000s, was resold for $201,000 in 2024, multiplying its initial price by 100 times.

Our ranking of the best capital gains recently recorded in New York confirms that India’s Modern masters offered the best returns on investment for works acquired for under $10,000 around twenty years ago.

Top 4 resales in New York in 2023-2024, for works previously purchased between $1,000 and $10,000

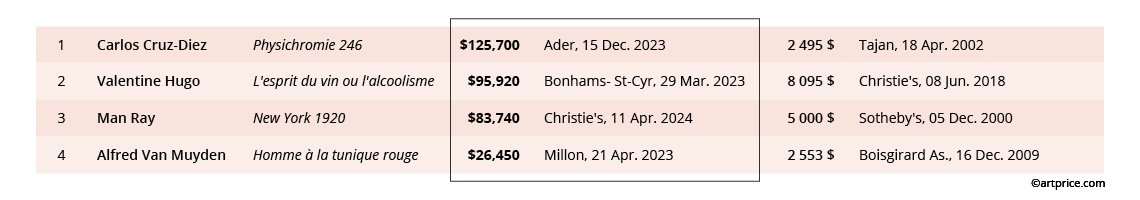

On the French market: Carlos Cruz-Diez in the lead

In France, the best resale goes to a master of Op-Art, Carlos CRUZ-DIEZ, whose price index shows an increase of 4% this year. One of his Physichromies, purchased for less than $2,500 in 2002, sold for more than $125,000 at the end of 2023 at Tajan in Paris.

Notable gains were also hammered on more discreet artists. For example, the Swiss painter Alfred Van Muyden and the Surrealist, Valentine HUGO. A canvas by the latter, L’Esprit du vin ou l’alcoolisme (The Spirit of Wine or Alcoholism), acquired for less than $10,000 six years ago, recently sold for $96,000.

Read our article: Surrealism’s key female artists surprise the market

Practical advice: on the Artprice page dedicated to Carlos Cruz-Diez, use the function “Advanced search” to refine your criteria. For example, search for Physichromies sold for less than $10,000 and identify the formats accessible in this price range.

Top 4 resales in Paris in 2023-2024, for works previously purchased between $1,000 and $10,000

In London: the triumph of Eugène Boudin

In London, the most spectacular resale of the year goes to Eugène BOUDIN’s Etude de Ciel. Estimated at $25,000, it ultimately sold for ten times more! This small pastel drawing, measuring around twenty centimeters, was purchased in Paris for less than $6,000 in 2017, and then resold for $259,000. This was also a new record for a drawing by Boudin, thus consolidating the value of his small works on the market.

Practical advice: to maximize your chances of acquiring a work by Eugène Boudin (or another artist), create an email alert on Artprice and keep an eye on local auction sales. These sales often offer more accessible prices than those of the major international auction operators.

Top 4 resales in London in 2023-2024, for works previously purchased between $1,000 and $10,000

Balloon Dogs: soaring prices and collection secrets

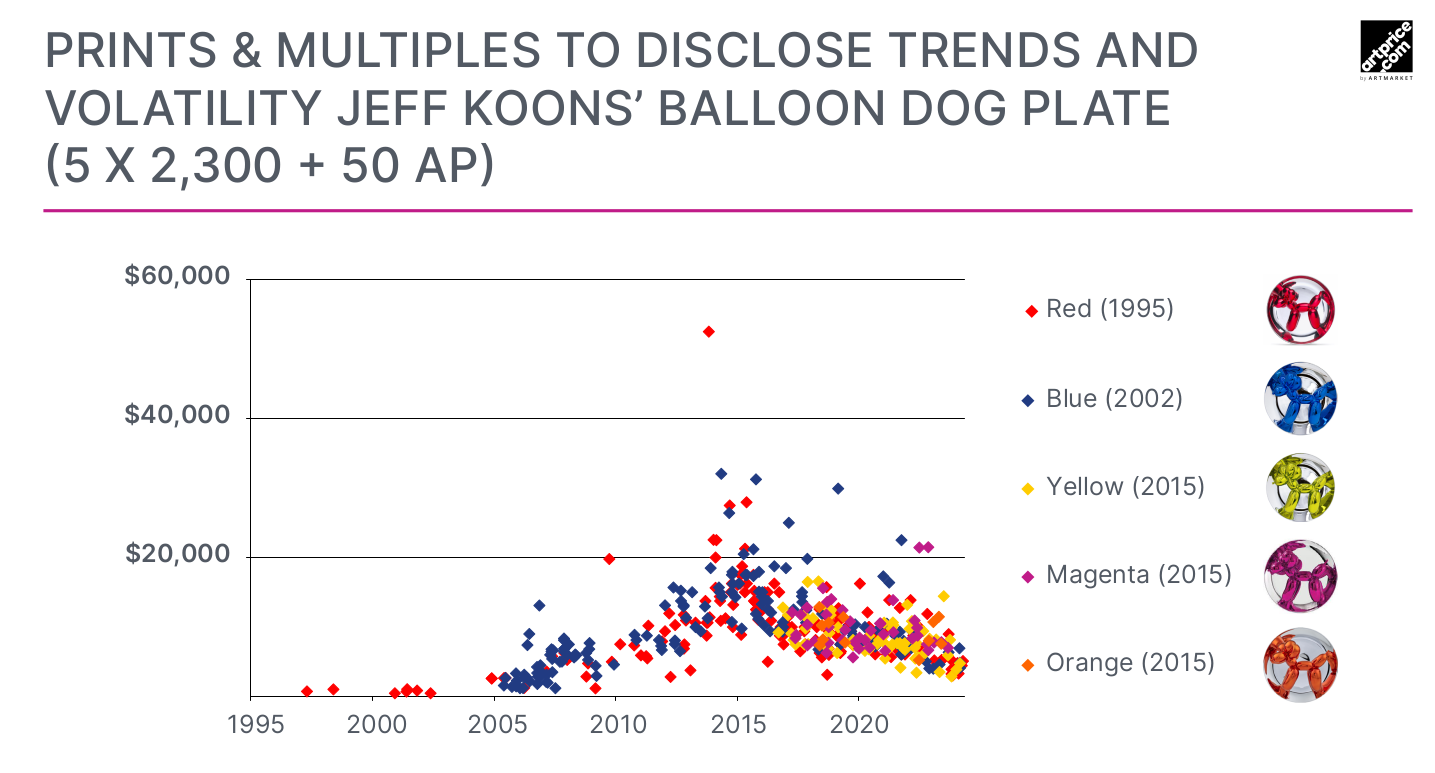

Works by Jeff Koons and Andy Warhol – two of the most expensive artists on the international art market – are not limited to multi-million dollar prices. They also include multiples that are often accessible for just a few thousand dollars. Among the most emblematic: porcelain Balloon Dogs by Jeff Koons and portraits of Marilyn Monroe by Warhol, available in various colors. These editions, true icons, have seen their prices increase over time, but not without some surprises.

Take the case of a small Balloon Dog by KOONS. The artist produced an edition of 2,300 copies (+50 artist proofs) in five distinct colors. In the early 2000s, these pieces could be acquired for $500 to $1,000. Today, they sell for between $5,000 and $7,000 at auction.

Some of these works have experienced spectacular value accretions. In 2013, a red version fetched $52,500 — ten times its usual price. Between 2014 and 2019, several blue versions also crossed the $25,000 mark. These peaks suggest a high level of volatility, the red and blue editions being much more popular than the yellow, orange or magenta ones produced later. Indeed, collectors clearly favor ‘historical’ editions, and the red Balloon Dog, which is approaching 30 years old, is a perfect example.

Practical advice: these porcelain Balloon Dogs are fragile and their value also depends on their condition. Those that have been damaged and then restored will be devalued compared to the best preserved examples. Do not hesitate to request a status report before bidding.

Why do the prices of Warhol’s Marilyns vary so much?

Andy Warhol’s screen prints of Marilyn Monroe are must-haves on the art market: more than 200 examples are traded every year at auction. But their prices range from $300 to over $500,000! So why such a huge discrepancy?

The most popular editions date back to 1967. Made by Warhol himself and published by Factory Additions in New York, they come in 250 portfolios, each containing 10 Marilyns in different colors. This series, which has become extremely rare, regularly reaches peaks with six-figure auction results.

Color screen printing, Ed. 250

Ketterer Kunst GmbH, Munich, 07/12/2024

It is a bit more complicated with another series, that of the screen prints Sunday B. Morning. In the 1970s, two Belgian associates launched these prints using – with his permission – Warhol’s original negatives and color codes. Unfortunately, the collaboration was never formally established. The first copies, stamped “Fill in your own signature” on the back, date from 1970 and are officially recognized. However, Sunday B. Morning continued to produce these screen prints, and their abundance has of course diminished their value.

As a result, the recent editions of Sunday B. Morning sell for a few hundred dollars only. With a budget of $3,000, it is even possible to acquire a complete portfolio of 10 Marilyns — or around $300 per print. On the market, however, these pieces can reach two, three or even four times this amount when offered individually.

Practical advice: For any Andy Warhol screen print, inquire about the type of edition and its date. The editions from the 1970s being the most valuable. Check the presence on the back of the stamp “Fill in your own signature” for a Sunday B. Morning edition.

Read previous articles in our series: Guide to art Auctions Under $10,000:

Part 1: Purchasing opportunities are growing

Part 2: $10,000: choose a unique work or build a collection?

Bonus: ‘seller fees’ elucidated

After paying buyers’ fees when acquiring your work at auction, if you subsequently sell the work (through the same channel) you will discover that seller fees are also charged. These variable fees depend on the services offered by the auction house: reproduction of the work in a catalog, advertising campaigns, and sometimes additional costs such as transport, restoration, cleaning and/or framing of the work.

The seller’s fees are fixed when the sales mandate is signed and can reach up to 30% including tax of the hammer price, depending on the auction house. Large operators like Christie’s and Sotheby’s often charge higher rates than more modest houses, justified by their high-end services which include prestige catalogs, sophisticated communication campaigns, international roadshows and targeted thematic sales.

Let’s look at an example: if your seller fees amount to 20% including tax and your Balloon Dog by Jeff Koons sells for $10,000, the auction house will take 20%, or $2,000. You will therefore receive $8,000 for the sale of your piece.

Good news: these fees are often negotiable, unlike buyer fees. The more valuable your item is, the more motivated the auction house will be to offer it at auction, which gives you an opportunity to ask for a discount. In the case of exceptional pieces, these costs can even be almost zero. On the other hand, for objects of average value, the margin for negotiation will be smaller.

Resale rights on sales of artworks

The artist’s resale right (ARR) is a royalty that is paid to a living artist or the beneficiaries of that artist on each resale of their works. This cumulative royalty, which starts at 4% at the low end and reduces to 0.25% at the high end (on sales > £500,000 in the UK for example) is capped at 12,500 euros and can be applied up to 70 years after the artist’s death. In France, it is collected by the Association for the Diffusion of Graphic and Visual Arts (ADAGP) or other artists’ committees.

This inalienable right ensures graphic and visual creators, and their beneficiaries, a share of the profits generated by successive sales of their works, thus guaranteeing their remuneration in the long term, well beyond the initial sale.

France was the first to create the resale right in 1920. This right does not exist in all countries. In addition to the member states of the European Union, around fifty countries around the world recognize resale rights.

For more information on the calculation of the amount of the resale right, follow this link Diffusion des Arts Graphiques et Plastiques (ADAGP

Taxation on sales of artworks in France

In France, when the sale price of an artwork exceeds 5,000 euros, tax resident sellers may be subject to capital gains tax, in addition to seller fees. However, exemptions are possible: if you are a professional seller or if you can prove you have owned the work for more than 22 years.

If you are not eligible for an exemption, you must declare the capital gain made on the sale of a work of art by completing form 2048-M-SD and submitting it to the tax services. This declaration, accompanied by payment of the tax due, must be made within one month after the sale. Find out about the taxation of artworks in your country.

The sale of an artwork at auction therefore involves a series of costs that have to be taken into account, which vary depending on the auction house and the services offered. Although these fees can reach up to 30% of the hammer price, it is possible to negotiate their amount, especially for high value pieces. These seller fees are essential to consider for a successful and surprise-free auction.

What are the fees for an auction buyer?

The buyer must pay the hammer price plus a proportional amount which varies depending on the auction house and the amount hammered, but which is generally between 10 and 25% excluding taxes. Buyer fees are indicated in the conditions of sale and publicly announced before the sale. It is therefore imperative to keep in mind, before raising your hand, that these amounts are added if your auction is successful!

Read: Buyer’s fees: is art getting more and more expensive? (2021)

If art is a doubly rewarding investment that enriches your life while offering exciting financial prospects, transforming an acquisition into real added-value requires vigilance. Understanding the intricacies of market prices and anticipating resale-related costs are all key to optimizing your returns. To help you with this task, Artprice subscriptions offer detailed statistics for every auctioned artist as well as clear visuals illustrating the factors that influence prices (see Artprice subscriptions). Use our art market information to make each purchase and /or sale an interesting opportunity!

Art Investment – Under $10,000 Art – Fees for Art Auctions – Investment Opportunities in Art

48.3

48.3